Written September 13rd. Prior to the completion of the Southwestern merger. The stock now trades under the name “Expand Energy (ticker: EXE)”

The market is severely overlooking Chesapeake Energy’s merger with Southwestern Energy, which will create North America’s largest natural gas producer.

My thesis lies in four key points: (1) Natural gas prices are at record lows and will quickly rebound (2) CHK-SWN’s superior Marcellus based assets will allow the company to out deliver peers at a quicker and cheaper rate (3) the CHK-SWN merger will create the dominant natural gas player in America, which has not been priced into the stock (4) Management is directly aligned with investor return and will outperform in capital efficiency when prices return, in addition to analysts overlooking management commentary.

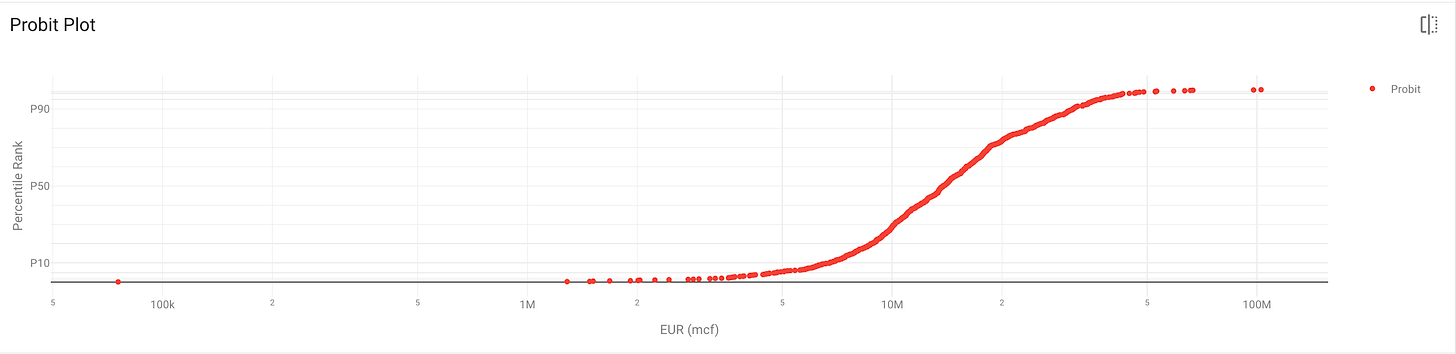

Production Estimates

Before I approach my thesis I would like to display CHK-SWN’s expected production. Asset quality is notoriously hard to evaluate and often leads to dislocations due to poor estimates. For a more accurate estimate of the company’s (‘the company’ refers to the combined entity of CHK-SWN) I used AlphaX’s Sky platform rather than the traditional ARPS curve. Sky is an artificial intelligence software which analyzes a well using all of its subsurface information.

AlphaX Sky Estimates

Standard ARPS Estimate

As you can see Sky predicts slightly less production volume, P50 EUR is really the number to look at. It’s only about 0.2 mcf less than ARPS, so a good sign. These production numbers are more to illustrate the company’s reliability and strength than for valuation purposes.

Thesis 1: Cyclical Prices

Natural gas prices are extremely cyclical. The WTI : HH ratio has been resting above 30 for the better part of the year, the highest since 2012.

WTI : HH Ratio

The disparity in oil and gas prices were caused by a spike in oil prices due to geopolitical conflicts coupled with a glut in gas prices going into the summer. The dislocation of prices were short-lived in 2012. Over the past 15 years the natural gas market has cratered and rationalized 3 times. U.S. gas inventories are currently at the top-end of historical ranges, but with warmer weather inventories should draw down in the near-term. Additionally, the curtailment of gas production by major producers will tighten the market in 2025 and 2026. Henry Hub prices are expected to rise to $3.40 in 2025.

Henry Hub Prices

In the long-term data centers will likely be the strongest catalyst for gas prices, and CHK-SWN is in an opportune position to benefit from the increased demand. The company’s inventory in the Marcellus will directly supply Northern Virginia’s data center market. I don’t want to spend too long on natural gas prices since the real value of the stock is the company’s operations, but I’m optimistic on future prices.

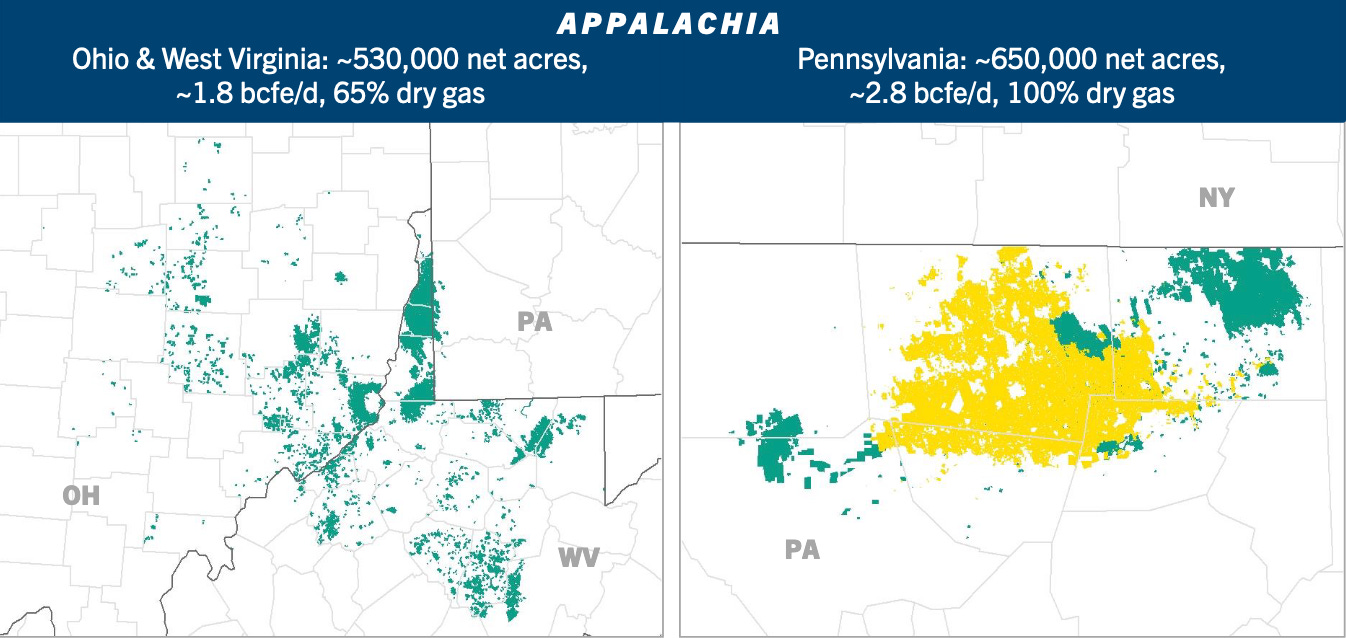

Thesis 2: Superior Inventory

CHK-SWN has superior assets with actionable inventory at $3/mcf in northeast Pennsylvania. The company has 273 $3/mcf sticks at a 70% IRR, adding 537 more locations at $4/mcf (data from FLOW Partners). When prices return the company will be best positioned to attack.

CHK-SWN Appalachia Inventory

In commodity businesses, you can have two types of competitive advantages.

You can be the lowest-cost producer due to production method

You can be the lowest-cost producer due to proximity

CHK-SWN benefit from both.

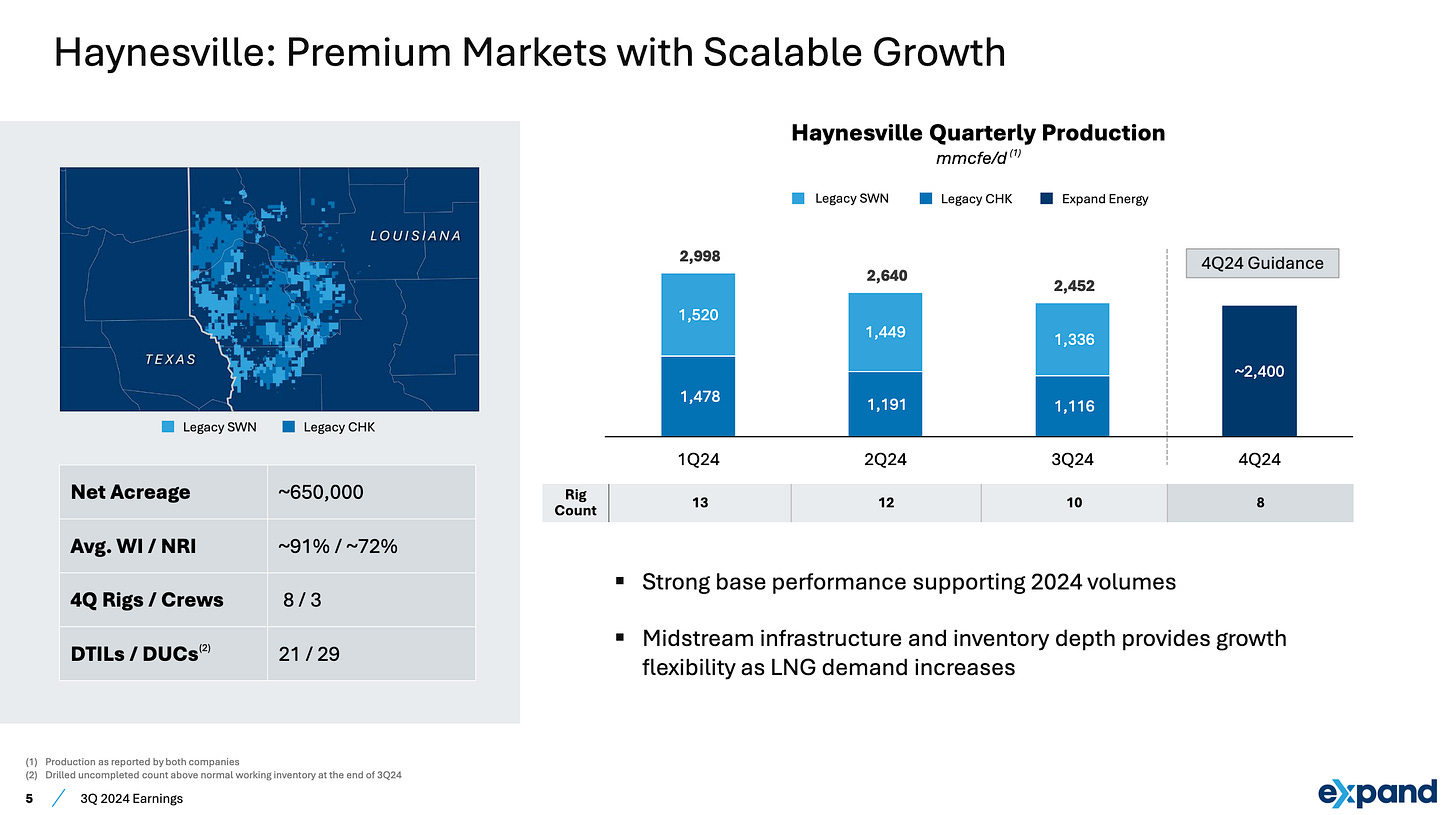

Additionally, Southwestern adds its Haynesville acreage which is some of the least-developed, highest-quality assets left in the basin. As LNG exports increase this acreage will be increasingly important and thereby expensive.

CHK-SWN Haynesville Inventory

Thesis 3: Premier Natural Gas Player

The completion of the CHK-SWN merger will create the largest independent natural gas producer in the country. The market has largely overlooked the juggernaut that will be created. The company’s gas production has over 5,000 gross locations and more than 15 years of inventory, an estimated 7.9bcfe/d of production.

CHK-SWN 3Q23 Gas Production

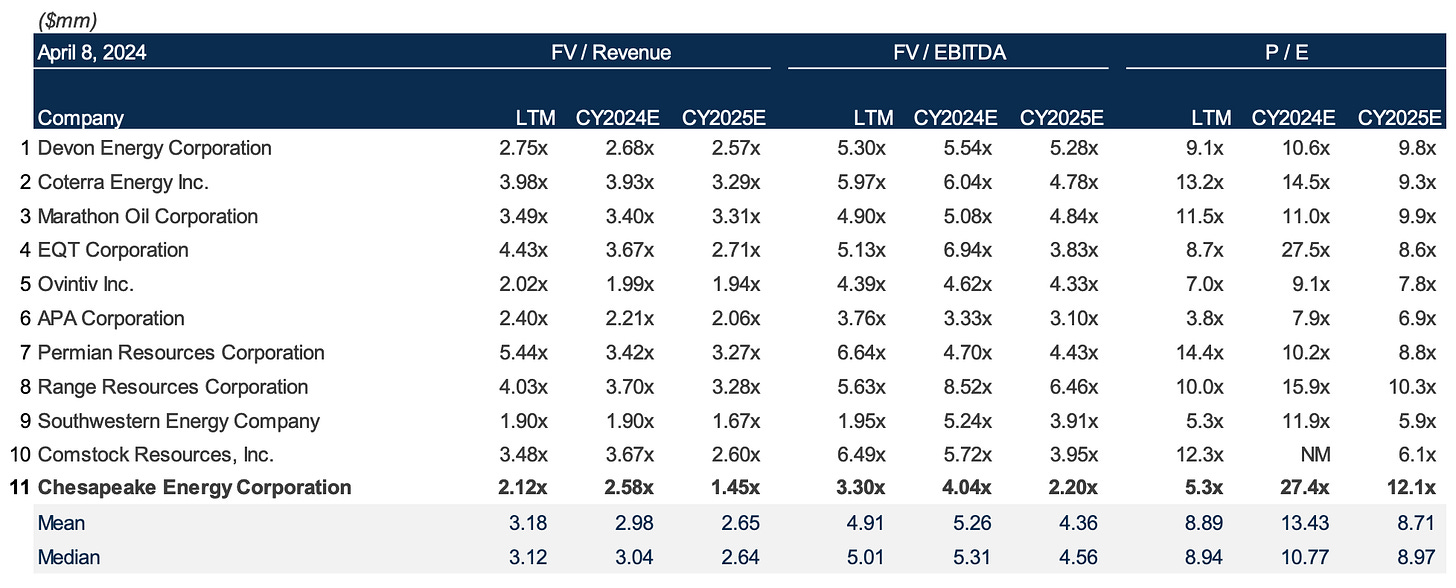

Furthermore, enhanced scale improves credit quality and the ability to deliver affordable gas to consumers. The company expects to sell 20% of LNG production overseas at a premium to domestic prices, and the merger is immediately accretive across all metrics. Moreover, Chesapeake is currently trading at a discount to its peers: CHK trades at a EV/EBITDA of 5.43x, while EQT trades at 9.19x, Antero Resources trades at 13.56x, and Chevron trades at 6.58x. Additionally, CHK has a price-to-book value of ~$79.50.

Thesis 4: Management Alignment and Capital Efficiency

Chesapeake management is directly aligned with returning cash flow to its shareholders. Management projects 20% more dividends/share over the next five years and expects to reach <1.0x net debt/EBITDAX within one year of the merger closing. The merger is expected to create $400 million of synergies/year, however management’s commentary is that it would not propose a number it could not beat. Considering Chesapeake’s equipment and placement in relation to Southwestern’s, I believe $400 million to be a conservative estimate. Additionally, Nick Dell'Osso, Chesapeake’s CEO, stated at a conference this past month that they are extremely confident in the merger’s position and expects an October completion date.

I had a Professor tell me that if I knew this information, then so does the market – I don’t agree. I ask why hasn’t the market reacted? I am confident that the stock will rally upon positive news regarding the FTC investigation and more-so upon Q3 earnings. Additionally, I spoke with the Chief Information Officer earlier in the year and commentary was very optimistic regarding merger synergies and asset quality.

Chesapeake has reacted to the declining natural gas prices by curtailing production and capital cuts, while other companies such as EQT have only announced reductions in production, not capital. The lack of willingness to cut capital when gas prices are so severely depressed shows a severe misalignment with shareholders.

Chesapeake Production Curtailment

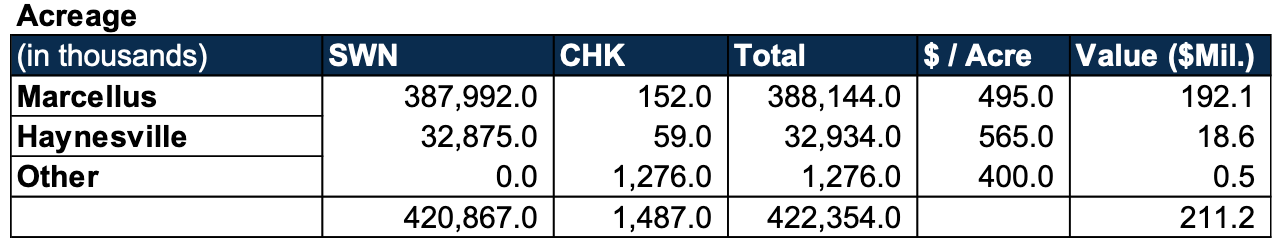

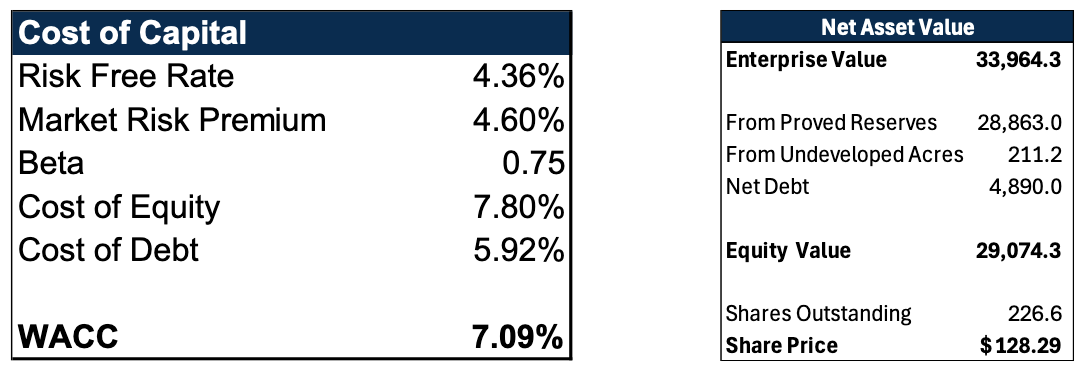

Valuation

I completed the following model on April 8th, 2024 using CHK & SWN’s Q1 numbers, however I still believe it helps provide some color. My recommendation on the company comes less from the valuation and more from qualitatively understanding Chesapeake and Southwestern’s operations.

Comparable Companies (sorted by market cap. large-to-small, exc. CHK)

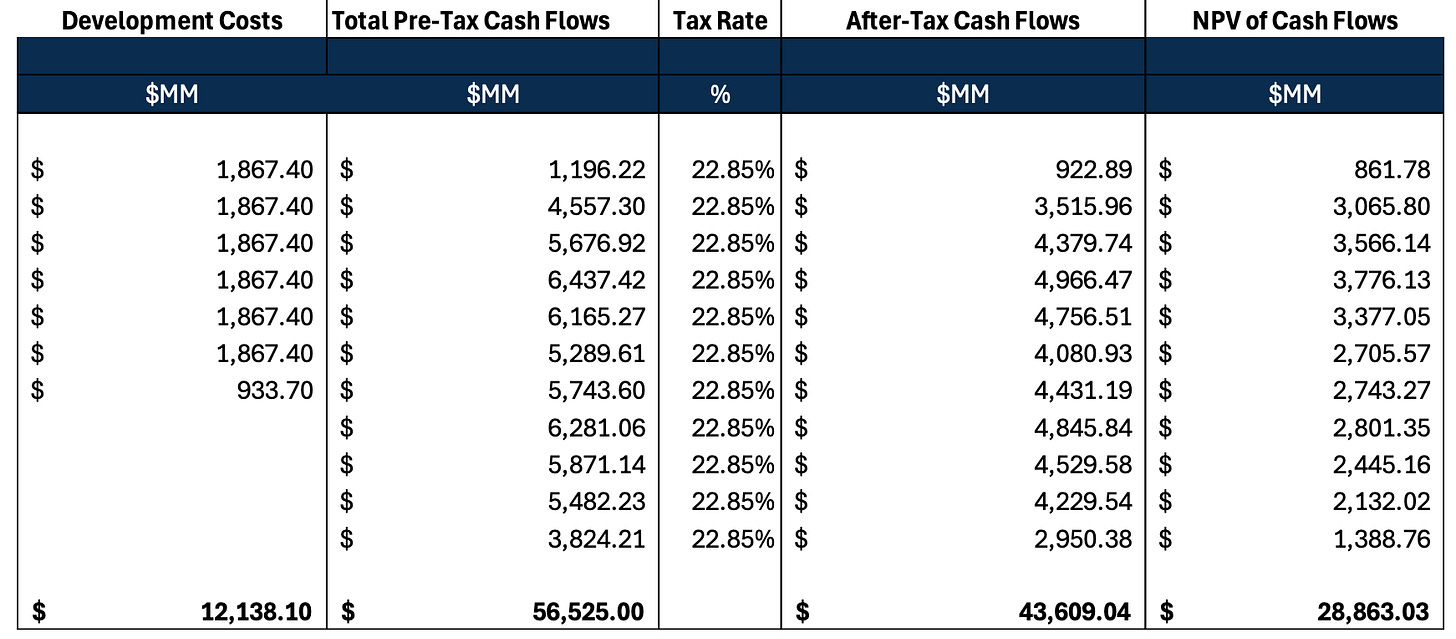

NAV Model

Assumptions

Gas Prices (starting with 2023): $2.64 - $2.41 - $3.60 - $3.85 - $4.00 (2027-2039)

Production:

Gas assumes 10% decrease in 2024, 5% increase in 2025, 3% increase in 2026 and 2027, flat for 2028 and 2029, 5% decrease from 2031-2038.

NGL assumes 10% increase in 2024, 22% increase in 2025, 25% increase in 2026, 13% increase in 2027, 8% increase in 2028, 6% increase in 2029, 4% increase in 2030 and 2031, flat for 2032 and 2033, 5% decrease in 2034 and 2035

Development costs are incurred at 20%/year until 0

$/acre found using sales only within past 6 years

Conclusion

I first invested in Chesapeake in March at around $85/share not so much for the reasons listed above, but because I liked the prospect of CHK-SWN being the leader in domestic LNG and I knew Chesapeake would drive down D&C costs for Southwestern. I bought more around $90/share. At the time I hadn’t learned much about investing fundamentals and the stock fell ~20%. But, like many college students studying finance, I read The Intelligent Investor this summer. My largest takeaway was Ben Graham’s stance on pricing – to focus more on buying a quality company at a discounted price (I didn’t understand the discounted price part before) than to attempt to time the markets fluctuation. I also read Richard Pzena on cyclical investing – focus on price cycles and the supply side issue. I also read about George Soros’s sizing methodology – when Druckenmiller brought the trade shorting the pound to him, Soros leveraged the entire firm to take a $10 billion position – when you have high conviction bet big.

In the past few months seeing Chesapeake reach $69, and listening to Graham’s, Pzena’s, and Soros’s advice, I have invested 100% of my money into Chesapeake. It is abundantly clear the market is not accurately valuing the company.

Edit November 18th. Connor Haley said at the Alta Fox pitch competition this past weekend that one of the things he’s most grateful he did in undergrad was starting a blog so I’m posting these now. Just wanted to update where my thesis is currently at.

(1) There has been a rebound in natural gas prices and I expect prices to push past $3.00 and even further in 2025. However, this is not the key focus of my pitch since it is a macro factor that is difficult to predict.

Henry Hub Prices

(2) Hit the nail on the head with this one. This wasn’t a huge secret, but to most retail investors and some sell-side groups this wasn’t evident, especially the low break-even in the Northeast Appalachian – I still don’t think this is fully priced in and we’ll see it materialize into 1Q25 or 2Q25’s earnings. Here’s two slides from Expand’s Q3 earnings highlighting my previous thesis points.

(3) Also kind of getting realized in the stock price now, but again don’t think it’s fully priced in. The company stated in their Q3 earnings they expect 7bcfe/d in 2025 and talks about LNG demand rising.

(4) Again, hit the nail right on the head with this, like dead on. Here’s a slide from their Q3 earnings

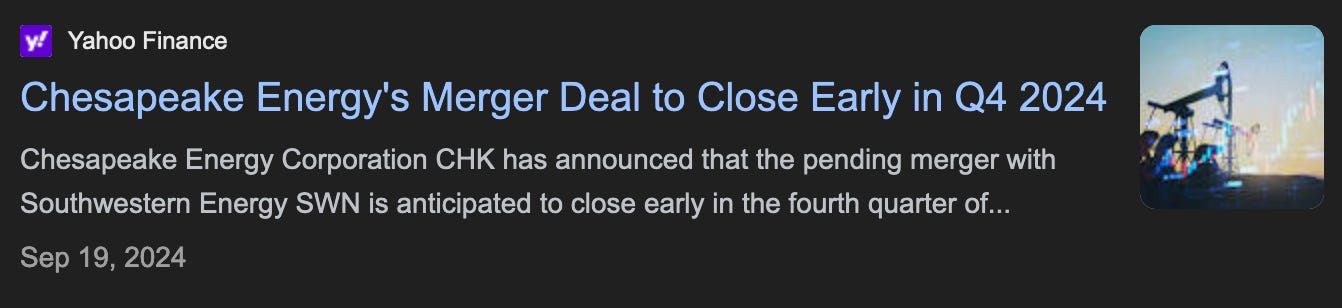

The company increased their expected synergies $100m or 25%, like I stated in the thesis. Management commentary in their earnings call is that they have a very high bar for what they deem a proved synergy and I still expect this estimate to be conservative. The stock rose 4% after Q3 earnings, then fell due to doubts about the election (that’s what I think at least) and rebounded 15% since then. Furthermore, I’ve attached screenshots of Reuters and Yahoo Finance articles about the expected close of the merger.

I only attached two screenshots, but there were tens of articles regarding this. From September 17th - 23rd the stock rose 10% due to the release of this news.

I finished this write-up on September 13th, prior to all of this news. Since the 13th, the stock is up over 30%. Honestly, kind of annoyed I listened to other people’s view about the stock. I know I could’ve placed with this pitch at a couple of university held pitch competitions, but I chose to stop working on it due to their views. Teaches a good lesson of following my own instinct I guess.